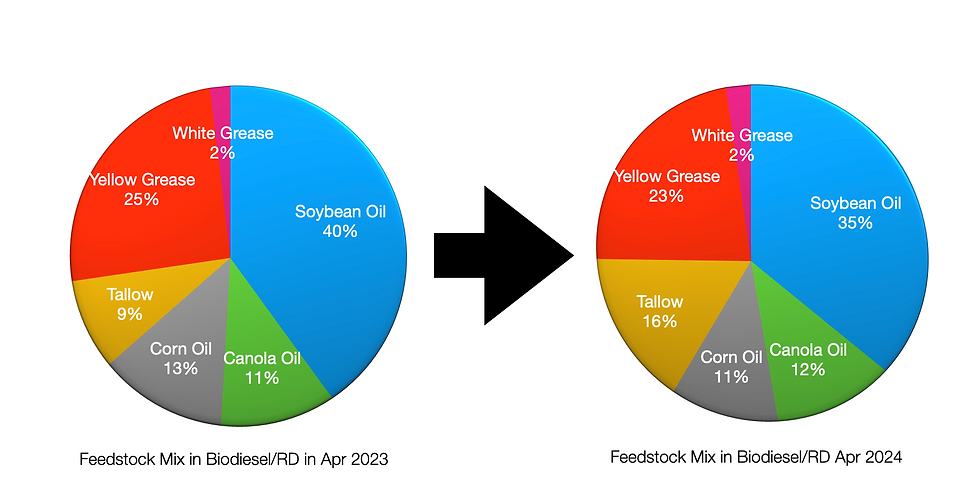

Soyoil backwardation to Dec ($37/mt) remains strong as US renewable diesel industry continues to draw upon all possible resources to maximize margin and production. RINs D4 values having grown to 0.68c/gal means that US excess production in excess of RVOs will most probably continue through end of Q3. We note in the last EIA feedstock report (always 3 months old) that RD drew on additional Tallow again at expense of Soyoil despite overall capacity for RD growing by 272 Mil gal (800Kt) to 4.1 Bil gal from Mar to Apr. Conventional Biodiesel overall capacity was barely changed. Imported UCO took all the press but is still relatively small in the reported other category despite cargoes of at least 130kt/month being imported. Obviously EU actions against China Biodiesel imports will make UCO from China even more compelling for US Renewable Diesel producers. Soyoil premiums FOB paranagua were suddenly weaker again and being offered at -230 vs bids at -390 for Sep. As stated already many times diesel weakness is never good for biodiesel demand and its feedstocks.

Comments